Today's whipsaw action hit me on the RUT position, the MNX trade had much better luck, so far so good, the portfolio is profitable, not as much as I wanted because of a bad decision I made on the RUT trade, but nevertheless, it is live and learn. As long as I learn as I go, I should be ok.

Position's Summary

09/30 RUT Iron Butterfly

09/30 MNX Iron Butterfly

Wednesday, September 30, 2009

09/30 RUT Iron Butterfly

RUT triggered two of my down-side adjustments, I turned the computer early in the session and notice that we were trading around 598, 1 standard deviation down.. Then I decided to place a contingent order to sell the NOV Put at 610, thinking if we bounce back hard, It is a good idea to get rid of it.. In perfect 20x20 hindsight, that decision wasn't very good. We bounced hard, hit the 610 level and came back down again...

When it was all said and done, selling the 510 Put ended up costing me 2% of the trade's P&L. Not to mention that I felt pretty bad for most of the day for making the decision of changing the plan mid-day.

How can I avoid that in the future? Simply trusting the plan I set the day before the market opens, this is the time when my decision making is not affected by market movement and I'm much more likely to make the right choice.. So, another item for my trading checklist: set the contingent orders and forget about the trade untill the final hour, where I can easily make any adjustments if needed.

On the bright side, the position theta is good, and I suspect most of the P&L drop is due to the volatility increase, so eventually that money will return as volatility has to go to zero as we approach OCT expiration.

When it was all said and done, selling the 510 Put ended up costing me 2% of the trade's P&L. Not to mention that I felt pretty bad for most of the day for making the decision of changing the plan mid-day.

How can I avoid that in the future? Simply trusting the plan I set the day before the market opens, this is the time when my decision making is not affected by market movement and I'm much more likely to make the right choice.. So, another item for my trading checklist: set the contingent orders and forget about the trade untill the final hour, where I can easily make any adjustments if needed.

On the bright side, the position theta is good, and I suspect most of the P&L drop is due to the volatility increase, so eventually that money will return as volatility has to go to zero as we approach OCT expiration.

09/30 MNX Iron Butterfly

Tuesday, September 29, 2009

09/29 Daily Summary

Today's consolidation was a nice gift! I appreciate that! Looking forward to a few more days just like it.. I fixed Yesterday's mistake I had made on the RUT position and Today its P&L started opening up. Both trades are progressing along nicely.

Position's Details:

09/29 RUT Iron Butterfly

09/29 MNX Iron Butterfly

Position's Details:

09/29 RUT Iron Butterfly

09/29 MNX Iron Butterfly

09/29 RUT Iron Butterfly

Yesterday I made a mistake, Today, rather than feeling sorry for myself, I went in there and fixed it! I sold both the extra NOV Put and Call I had in the portfolio, this provided me with the same delta exposure, but a lot more theta to work with. Because I did it early in the morning, I was able to capture most of that daily theta by end of Day. It also helped that the market didn't move much Today!

09/29 MNX Iron Butterfly

Monday, September 28, 2009

09/28 Daily Summary

I must add the following check-list to use for end-of-day adjustment AND contingent order placement:

a) Check for long PUT or CALL that can be sold to cut deltas

b) Check for any delta hogs that need to be rolled to cut deltas

c) Add long PUT or CALL to cut delta

Last week, when I created my contingent orders, I didn't add an order to sell the long Nov PUT for the RUT position, this was a mistake on my part that I only caught up with Today while documenting the position. Add that to the MNX oversigh, thats two strikes on the same topic. Hence the need for the checklist.

Position's Details:

09/28 RUT Iron Butterfly

09/28 MNX Iron Butterfly

a) Check for long PUT or CALL that can be sold to cut deltas

b) Check for any delta hogs that need to be rolled to cut deltas

c) Add long PUT or CALL to cut delta

Last week, when I created my contingent orders, I didn't add an order to sell the long Nov PUT for the RUT position, this was a mistake on my part that I only caught up with Today while documenting the position. Add that to the MNX oversigh, thats two strikes on the same topic. Hence the need for the checklist.

Position's Details:

09/28 RUT Iron Butterfly

09/28 MNX Iron Butterfly

09/28 RUT Iron Butterfly

Today's price action was strong to the up-side, the position maintained its current P&L. I didn't realize this last Friday, but on my inventory I had a long Nov PUT that I needed to get rid of if we moved higher, we did Today and instead of dumping that PUT I ended up buying calls, the effects on the delta is the same, however, by selling the PUT I'd be getting some extra theta and also keeping some of the PUT's value in the trade.

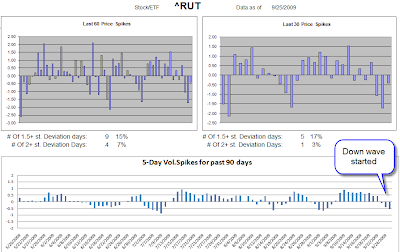

By looking at the volatility chart, one can realize the market is starting to get "agitated" with bigger days showing up.

By looking at the volatility chart, one can realize the market is starting to get "agitated" with bigger days showing up.

09/28 MNX Iron Butterfly

Friday, September 25, 2009

09/25 Daily Update

I had an oversigh error on the MNX position, forgot to sell a Long NOV Call I have in the inventory, no big deal, can be taken care Monday. Other than that, I'm looking to sit back and relax over the weekend, the positions are in decent shape and contingent orders already in place for Monday!

Position's Details:

09/25 RUT Iron Butterfly

09/25 MNX Iron Butterfly

Position's Details:

09/25 RUT Iron Butterfly

09/25 MNX Iron Butterfly

09/25 RUT Iron Butterfly

09/25 MNX Iron Butterfly

Ooops, I didn't notice I had a long NOV Call and didn't dumpt it at the end of day Today.. I have a contingent order to sell it Monday Morning if we tick down to 169. Even with that mistake, the position is working its way up in the P&L ladder. Contingent orders in place and ready to roll on Monday.

By the end of day Today, I didn't want to buy long PUTs (granted, I didn't notice I had a NOV Call to sell), so my down-side adjustment comes in closer than 1 st. deviation. I didn't want to be preemptive.

By the end of day Today, I didn't want to buy long PUTs (granted, I didn't notice I had a NOV Call to sell), so my down-side adjustment comes in closer than 1 st. deviation. I didn't want to be preemptive.

Thursday, September 24, 2009

09/24 Daily Update

Gotta love those contingent orders! In the old days I'd be following the market and thinking (over-thinking) about all possible scenarios.. Today all I had to do was: Nothing... The contingent orders where in place, I had confidence in their execution, I had prepared by studying the positions the night before, so the execution was taken care by TOS and their software.

Now, this is a follow the market approach. If we sit here for the next few days, great! Otherwise, we'll start making adjustments to the down-side or up-side. One way or the other, the approach is the same: I don't have to pick the direction, of course, if we move too much I lose, otherwise I win.

Position's details:

09/24 RUT Iron Butterfly

09/24 MNX Iron Butterfly

Now, this is a follow the market approach. If we sit here for the next few days, great! Otherwise, we'll start making adjustments to the down-side or up-side. One way or the other, the approach is the same: I don't have to pick the direction, of course, if we move too much I lose, otherwise I win.

Position's details:

09/24 RUT Iron Butterfly

09/24 MNX Iron Butterfly

09/24 RUT Iron Butterfly

RUT rolled down Today and the position adjusted itself thanks to all the contingent orders I had in place. The P&L dropped by a few percentage points, but it is still above water. I may have been a bit preemptive rolling those 610 calls up, but then again, not sure the picture would be much different right now (I would have purchased a long NOV CALL instead).

Notice the price action and VIPES chart in the bottom of this posting. You'll see that RUT has been more aggressive on its moves in comparisson with MNX. Today's pull back was stronger on the RUT.

Notice the price action and VIPES chart in the bottom of this posting. You'll see that RUT has been more aggressive on its moves in comparisson with MNX. Today's pull back was stronger on the RUT.

09/24 MNX Iron Butterfly

Wednesday, September 23, 2009

09/23 Daily Update

Both positions got a good break Today as the markets sold off in the final hour of trading. I was about to make up-side adjustments, but noticed the sentiment was changing.

I got a few interesting ideas from the California 1 trading group meeting Today, it seems a few of the folks are trading the weekly contracts on OEX and someone also thought about buying a calendar end of day Friday to sell it on Monday for profit to bank on Market Maker's habit of pushing vols lower on Friday and pumping it back up on Monday. I'll do some experimenting with them in the next few weeks.

Position's Details:

09/23 RUT Iron Butterfly

09/23 MNX Iron Butterfly

I got a few interesting ideas from the California 1 trading group meeting Today, it seems a few of the folks are trading the weekly contracts on OEX and someone also thought about buying a calendar end of day Friday to sell it on Monday for profit to bank on Market Maker's habit of pushing vols lower on Friday and pumping it back up on Monday. I'll do some experimenting with them in the next few weeks.

Position's Details:

09/23 RUT Iron Butterfly

09/23 MNX Iron Butterfly

09/23 RUT Iron Butterfly

09/23 MNX Iron Butterfly

The position got a break Today as the market sold off in the final hour of trading. I'm looking for a consolidation from here, will be specially good if we spend a few days a bit further down. Contingent orders in place, waitting on Tomorrow.

Sometimes, luck helps you out too. MNX got within .10 points from hitting my up-side adjustment and backed off, if we had hit that adjustment, I would have given up 1/2 of the profits the position made when it reverted direction to the down-side.

Sometimes, luck helps you out too. MNX got within .10 points from hitting my up-side adjustment and backed off, if we had hit that adjustment, I would have given up 1/2 of the profits the position made when it reverted direction to the down-side.

Tuesday, September 22, 2009

06/22 Daily Summary

I apologize for not posting Yesterday, I was traveling from Salvador/Brazil to Sunnyvale/California and after such a long journey I had no energy left to post on the blog. I was barely able to create contingent orders for Today. To be trully honest, I'm glad they were not needed Today, because I had little faith in my mental state Yesterday to make sure the contingent orders were good :)

By the end of day Today I felt that it was time to cut a few deltas from both my positions, I used different approaches on the RUT and MNX trades, you can see on the details:

Position's Details:

09/22 RUT Iron Butterfly

09/22 MNX Iron Butterfly

By the end of day Today I felt that it was time to cut a few deltas from both my positions, I used different approaches on the RUT and MNX trades, you can see on the details:

Position's Details:

09/22 RUT Iron Butterfly

09/22 MNX Iron Butterfly

09/22 RUT Iron Butterfly

I did a vertical roll to adjust my position Today. I noticed that we were leaning short deltas and didn't want to add a long CALL, as it would simply smash my theta. So I moved the short 610 Call to the 620 strike level. While this might have been a bit preemptive based on Dan's rules, I felt it was ok to do so.

Notice on the 5-Day Vipes chart that we might be slowing down on the upward pressure, notice that for the past 2 days bars. That being said, there has been very little "down days", as we seem to find buyers every time we move lower, so I have to keep on playing the non-directional approach.

Notice on the 5-Day Vipes chart that we might be slowing down on the upward pressure, notice that for the past 2 days bars. That being said, there has been very little "down days", as we seem to find buyers every time we move lower, so I have to keep on playing the non-directional approach.

09/22 MNX Iron Butterfly

At Today's closing I felt the need to control the deltas, they were getting out of hand, so I added a long NOV contract. Cut delta from -56 to -33, keeping it around the 1:1 ratio. I didn't want to go overboard here.

I notice on the 5-Day VIPES graph that we still have upward pressure. This seems to be slowing down on the RUT profile, however, notice we only had "up" days for almost 2 weeks now.

I notice on the 5-Day VIPES graph that we still have upward pressure. This seems to be slowing down on the RUT profile, however, notice we only had "up" days for almost 2 weeks now.

Friday, September 18, 2009

09/18 Daily Summary

I hope everyone enjoys the weekend, I sure will! No major change on both positions Today, that's always good news! I have also posted my backtesting for the RUT Iron Butterfly.

Position's Details:

09/18 RUT Iron Butterfly

09/18 MNX Iron Butterfly

09/18 Backtesting RUT Iron Butterfly

Position's Details:

09/18 RUT Iron Butterfly

09/18 MNX Iron Butterfly

09/18 Backtesting RUT Iron Butterfly

09/18 MNX Iron Butterfly

09/18 Backtesting RUT Iron Butterfly

I spent the past 2 weeks backtesting the RUT Iron Butterfly, I used TOS thinkback for the backtesting, therefore the adjustments can only be made as end-of-day trades, meaning the use of contingent orders can't be considered.

My goal in backtesting is to get a feel for the trade, the number of adjustments and the way it survives the most different and wild market conditions. I noticed that this strategy requires adjusting regardless of the environment, as you can see on the charts bellow, you adjust even when the price is totally within 1 st. deviation on the volatility cone. On the Bright side you can make money even if the market goes way out of the cone.

Like Dan Harvey puts it, this is a market-following strategy, and the name of the game is to keep theta comming regardless of where the market is going.

My goal in backtesting is to get a feel for the trade, the number of adjustments and the way it survives the most different and wild market conditions. I noticed that this strategy requires adjusting regardless of the environment, as you can see on the charts bellow, you adjust even when the price is totally within 1 st. deviation on the volatility cone. On the Bright side you can make money even if the market goes way out of the cone.

Like Dan Harvey puts it, this is a market-following strategy, and the name of the game is to keep theta comming regardless of where the market is going.

Subscribe to:

Comments (Atom)