Today I did a cut and roll on my MNX put spreads, I realized that by keeping the trade hedged I let go of the opportunity to accumulate some profits as the NDX did. Live and learn, next time I plan on not leaving the position in a "waitting mode" for too long.

Position's details and price action chart

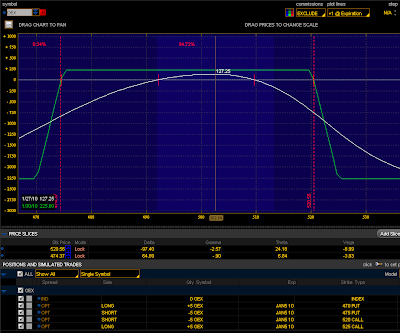

01/26 NDX Iron Butterfly

01/26 MNX Iron Butterfly

01/26 OEX Weekly Iron Condor