I'm very happy to say I'm up just above 2% on the current open positions. Most positions did recover well after a few days of indecision in the market. As far as I'm concerned, let's stay directionless for another week, shall we?

I posted another KEY posting Today: When do I cut Deltas on Iron Butterflies? This is answering a question I have received a couple of times already: when/how do I cut deltas? I made my best to explain in there, everyone, feel free to share your thoughts, comments, etc.

Position's Details:

08/27 IBM Calendar

08/27 RUT Iron Butterfly

08/27 MNX Iron Butterfly

Thursday, August 27, 2009

When do I cut Deltas on Iron Butterflies?

I have seen this question a couple of times on the blog, and I must say, there is no exact answer, at least not from me. I don't have an exact formula, I go by a guideline and the most important thing for me is evaluating the trade every day before the market closes. One blog reader posted another blog where the author explains his formula, allow me to say a few things about how I have been doing it.

As I mentioned before, I have been following most of Dan Harvey's advice on how to trade these Iron Butterflies. Dan is a veteran trader who mentors at the Dan Sheridan program. I had the great pleasure of meeting him in San Francisco in one of Sheridan's seminars. Dan's rules are complex and quite well detailed, I follow most of them, but I'm the first to admit I'm still studying them, so can't claim to be a perfect follower. One of the most important things to know is that trading rules have to adapt to the trader's style, each trader has his/her own approach to things.

Also, important to notice is that the greeks will be quite different depending on the underlying you trade. The delta : theta ratio also depends on the size of the position, your willingness to take more or less risk, etc.

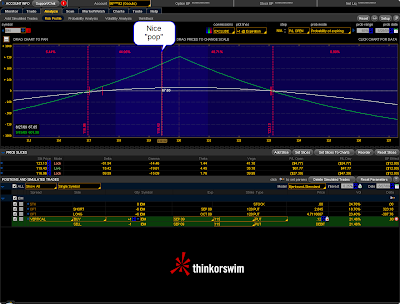

For the MNX position, I work in keeping the theta to delta ratio of 1:1, meaning if my theta is about 30, my delta shouldn't be much more than that. I also look at the risk profile and evaluate the 1-day 1-standard deviation move, if I notice that a 1-standard deviation move in any direction can take too much of my profits, I'll come in and cut some of the deltas. Every day I post those charts and the light-blue area is where Think or swim estimates 1 st. deviation to be for 1 day. Another rule-of-thumb I use is to place contingent orders in points where my delta is twice as much as my theta, to cut it in 1/2 and bring it back to a 1:1 ratio.. This has worked fairly well. I preffer to keep these contingent orders at least 1 standard deviation away from the closing price, otherwise it may whipsaw, as it happened to me back in June for my DIA Iron Butterfly trade.

For the RUT position, I don't know yet.. Sorry, no genius here, just a guy working on his craft :) I believe Dan Harvey recommends a theta to delta ratio of 3:1. However, this is for larger positions, My RUT position is the same size of the MNX, and because this is the first time I trade it, I'm not quite sure where the ratio should be. Honestly, I've been looking at the 1-day 1-st. deviation zone in the profile chart and evaluating if I can handle that kind of move, if not, I cut the deltas, if yes, I simply place the contingent orders there.

I try cutting the deltas in about 1/2 when I use contingent orders. It is BEST when you do this overnight and stop looking at it. This very month, I was watching when the MNX dropped 2 st. deviations and I over-adjusted the trade. The best practice, as far as I can tell from back-testing is to cut it in 1/2 and cut in 1/2 again if it keeps on moving.

Then again, evaluating the position at the end of the day is the most critical element here. I ask myself the question: If we go Up, am I ok? If we go Down, am I ok? If not, I adjust before closing, if yes, I put contingent orders around the 1 st. deviation zone.

I hope this helps, feel free to post your comments, share ideas, suggestions.. It is an open board here.

Cheers to our Success!

Gustavo

First the other trader's opinion is here:

http://www.optionsropeadope.com/2008/05/13/greek-exposure-calculations/

As I mentioned before, I have been following most of Dan Harvey's advice on how to trade these Iron Butterflies. Dan is a veteran trader who mentors at the Dan Sheridan program. I had the great pleasure of meeting him in San Francisco in one of Sheridan's seminars. Dan's rules are complex and quite well detailed, I follow most of them, but I'm the first to admit I'm still studying them, so can't claim to be a perfect follower. One of the most important things to know is that trading rules have to adapt to the trader's style, each trader has his/her own approach to things.

Also, important to notice is that the greeks will be quite different depending on the underlying you trade. The delta : theta ratio also depends on the size of the position, your willingness to take more or less risk, etc.

For the MNX position, I work in keeping the theta to delta ratio of 1:1, meaning if my theta is about 30, my delta shouldn't be much more than that. I also look at the risk profile and evaluate the 1-day 1-standard deviation move, if I notice that a 1-standard deviation move in any direction can take too much of my profits, I'll come in and cut some of the deltas. Every day I post those charts and the light-blue area is where Think or swim estimates 1 st. deviation to be for 1 day. Another rule-of-thumb I use is to place contingent orders in points where my delta is twice as much as my theta, to cut it in 1/2 and bring it back to a 1:1 ratio.. This has worked fairly well. I preffer to keep these contingent orders at least 1 standard deviation away from the closing price, otherwise it may whipsaw, as it happened to me back in June for my DIA Iron Butterfly trade.

For the RUT position, I don't know yet.. Sorry, no genius here, just a guy working on his craft :) I believe Dan Harvey recommends a theta to delta ratio of 3:1. However, this is for larger positions, My RUT position is the same size of the MNX, and because this is the first time I trade it, I'm not quite sure where the ratio should be. Honestly, I've been looking at the 1-day 1-st. deviation zone in the profile chart and evaluating if I can handle that kind of move, if not, I cut the deltas, if yes, I simply place the contingent orders there.

I try cutting the deltas in about 1/2 when I use contingent orders. It is BEST when you do this overnight and stop looking at it. This very month, I was watching when the MNX dropped 2 st. deviations and I over-adjusted the trade. The best practice, as far as I can tell from back-testing is to cut it in 1/2 and cut in 1/2 again if it keeps on moving.

Then again, evaluating the position at the end of the day is the most critical element here. I ask myself the question: If we go Up, am I ok? If we go Down, am I ok? If not, I adjust before closing, if yes, I put contingent orders around the 1 st. deviation zone.

I hope this helps, feel free to post your comments, share ideas, suggestions.. It is an open board here.

Cheers to our Success!

Gustavo

First the other trader's opinion is here:

http://www.optionsropeadope.com/2008/05/13/greek-exposure-calculations/

08/27 IBM Calendar

08/27 RUT Iron Butterfly

Not such a huge move in profits, but we're moving a few percentage points per day, that's a good recovery pace. I also added a long OCT contract Today to keep the deltas under control sort of speak. After the market closed, I went back to my profile and realized I would be better off by rolling one of the short SEP 650 Calls using a debit spread.

Depending on where we are Tomorrow, I might do just that and sell some of the long OCT contracts. The reason behind rolling these 650 calls is simple: They're getting too far In The Money, theyr delta is approaching 80, and there is not much time value left in them, so they're what Dan Harvey calls a "Delta Hog", as they become harder and harder to control as time goes by.

Previous Posting:

08/26 RUT Iron Butterfly

Depending on where we are Tomorrow, I might do just that and sell some of the long OCT contracts. The reason behind rolling these 650 calls is simple: They're getting too far In The Money, theyr delta is approaching 80, and there is not much time value left in them, so they're what Dan Harvey calls a "Delta Hog", as they become harder and harder to control as time goes by.

Previous Posting:

08/26 RUT Iron Butterfly

08/27 MNX Iron Butterfly

Today the trade made a nice run for profitability. I like it! One thing I noticed by the end of the day was that my deltas were approaching -40, this to me seemed like too much and would put me in the B/E if we had 1 st. deviation move to the upside, so I cut the deltas adding another long OCT call to keep it in line with the theta.

Interestingly enough, a blog reader asked me how do I determine when/where to cut my deltas in the position. Let me explain this in a separate posting.

Interestingly enough, a blog reader asked me how do I determine when/where to cut my deltas in the position. Let me explain this in a separate posting.

Subscribe to:

Comments (Atom)