No NDX Iron butterfly in place right now, the covered calls are working out ok with this recent up move.

No NDX Iron butterfly in place right now, the covered calls are working out ok with this recent up move.

Tuesday, March 29, 2011

3/29 Daily Summary

No NDX Iron butterfly in place right now, the covered calls are working out ok with this recent up move.

No NDX Iron butterfly in place right now, the covered calls are working out ok with this recent up move.

Monday, March 28, 2011

3/28 Daily Summary

Friday, March 25, 2011

3/24 Daily Summary

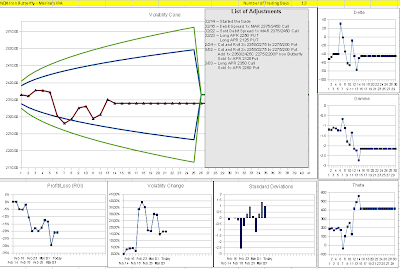

First and foremost, let me go out and say it: I'm glad I'm not in the APR butterfly right now.. Look at this 30 day st. deviation chart, for about a month we have had 1 large day just about every other day.. This means a lot of adjusting to stay in the trade, in fact, the position I considered entering this week would be already undergone a cut and roll.

First and foremost, let me go out and say it: I'm glad I'm not in the APR butterfly right now.. Look at this 30 day st. deviation chart, for about a month we have had 1 large day just about every other day.. This means a lot of adjusting to stay in the trade, in fact, the position I considered entering this week would be already undergone a cut and roll.I'm in the process of re-evaluating all my trading, pros and cons, and the fact that with the newborn baby I want to spend some time with my family. I'm a firm believer that your trading style needs to match your lifestyle and personality. With a new baby and additional responsibilities at work, I'm finding the simple cash-secured put/covered call strategy a blessing from the sky.. :)

A reader posted a few good questions on my last posting, so let me repeat them here and address them to all:

What type of returns do you look for in your naked puts?

About 1 to 1.5% over the value held in margin. For a current position, I've sold the 72.5 vall on COST for about .70c, it is a bit below my goal, but since I was assigned COST last month, I wanted to start writing the calls anyway.

Overall, I'm looking to get about the same or better results as the market, with reduced volatility by selling the calls and puts to bring money into the bank when the stocks are moving side-ways.

Why naked puts over just buying the stock?

I start with selling a naked put, then I let it be assigned into stocks. Once I own the stocks I start selling the covered call. First of, you need to select the stocks you would like to own right away. Then, but selling extra premium with options you bank some money every month and reduce your down-side risk on the stock.

Isnt the margin and downside risk almost the same yet your participation on the upside is capped?

Yes, it is, the upside is capped, but I'm not looking to do this strategy on fast-moving stocks. My goal is to select a few stable stocks that I won't mind owning and keep selling premium every month, so while it seems the upside is capped, because you "refresh" everything, you essentially bring money every month regardless of what the stock does.

Wednesday, March 23, 2011

3/23 Daily Summary

Just a brief update Today, I don't have my usual NDX Iron butterfly on as I have decided to take a break on the APR cycle. I have started a few covered call/cash-secured put trades, my plan is to do something very simple this month and repeat it moth after month on the long-term portion of my portfolio. This is actually working well as I am working with my wife on this very simple strategy, it is good to have her engaged on this, a great partnership for sure!

Just a brief update Today, I don't have my usual NDX Iron butterfly on as I have decided to take a break on the APR cycle. I have started a few covered call/cash-secured put trades, my plan is to do something very simple this month and repeat it moth after month on the long-term portion of my portfolio. This is actually working well as I am working with my wife on this very simple strategy, it is good to have her engaged on this, a great partnership for sure!

Monday, March 21, 2011

3/21 Daily Summary

Sunday, March 20, 2011

3/20 Daily Summary

Wednesday, March 16, 2011

3/16 Daily Summary

I have not started the APR position yet. To be quite honest I may just sit it out this month, give myself some time to regroup. The market seems to need some of that time out as well, notice the last 2 days have been really aggressive, Yesterday with a big gap down and Today with a crash down in prices. I'm glad I'm out to say the least.. Let's see how this market behaves moving forward.

A big thank you to the readers that posted their support on my last month's trading accident. I've basically gone back to flat in my 1-year performance, which is a big pain... Like I said, I need to spend the time and review play by play this MAR position as well as all my past trades to recognize the issues and lessons learned before jumping in the water again.. I find that back testing and journal review is a good way for me to build up confidence. I've been having very busy week days, so plan on doing it over the weekend. For now, will keep watching the day by day market action as I do have a few cash-secured puts/covered call positions I'm working on for the long-term portion of my portfolio.

Sunday, March 13, 2011

Keeping it in Perspective

Just wanted to do a quick and brief post. Let's keep things in perspective in light of such horrible news around Japan, I can't even start to complain about a bad trade in March.

LIFE, this is what really matters, so my heart goes to all families and people who are struggling in Japan right now. If you're reading this blog, please take the time and think about how can you help folks around there. Donate, pray, engage, who knows, just sending some positive thoughts is already a good start.

Peace,

Gustavo

LIFE, this is what really matters, so my heart goes to all families and people who are struggling in Japan right now. If you're reading this blog, please take the time and think about how can you help folks around there. Donate, pray, engage, who knows, just sending some positive thoughts is already a good start.

Peace,

Gustavo

Friday, March 11, 2011

3/11 Daily Summary

Today I didn't see any recovery in the morning and decided to just exit the position. I was sick to my stomach to take this big loss -33%, it is a double-hit for 2 reasons:

1) It was way over my average win, and beyond my plan to control the losses and keep then to 1.5x the average win, this trade took 2 big hits with overnight gaps, the first time around I survived, the second time around no, I took the hit.

2) I had just started increasing in my position size. This is a double hit, as this is one of my biggest positions since I started tracking on the blog, it will certainly set me back by quite a bit.

All and all, I have to regroup, it is disheartening to be set back that much. I will have to do some hard thinking and figure out what to do from here. For now will take a break over the weekend, and do some hard thinking..

Cheers!

Gustavo

1) It was way over my average win, and beyond my plan to control the losses and keep then to 1.5x the average win, this trade took 2 big hits with overnight gaps, the first time around I survived, the second time around no, I took the hit.

2) I had just started increasing in my position size. This is a double hit, as this is one of my biggest positions since I started tracking on the blog, it will certainly set me back by quite a bit.

All and all, I have to regroup, it is disheartening to be set back that much. I will have to do some hard thinking and figure out what to do from here. For now will take a break over the weekend, and do some hard thinking..

Cheers!

Gustavo

Thursday, March 10, 2011

3/10 Daily Summary

My plan a couple days ago was to condorize the position this Thursday morning. Well, this was one day too late.. Unfortunately NDX did not agree with my plan and decided to roll down and gap down in the morning. The contingent orders did their job, now I have to wait for the dust to settle and condorize the position, or whatever is left of it.

My plan a couple days ago was to condorize the position this Thursday morning. Well, this was one day too late.. Unfortunately NDX did not agree with my plan and decided to roll down and gap down in the morning. The contingent orders did their job, now I have to wait for the dust to settle and condorize the position, or whatever is left of it.On the bright side, I expect the spreads to be wider than normal so get a break if we are not moving too fast again Tomorrow.. When this happens I try to make adjustments that touch the trade as little as possible, because the more you trade on wide spreads, the worse off you are (you buy into the over priced contracts).. So, I'll have to wait and see where we are Tomorrow morning and make my exit move.. Will put the trade in a position that I can stand a large move on Monday.

Wednesday, March 9, 2011

3/9 Daily Summary

No major change Today, except I had to update my trading plan as if we trade lower Tomorrow I will need to add a stronger put to compensate for the delta and Theta, this makes me tweak the adjustment on the second level down (do a strangle instead of selling the long Call) because of margin in one of my accounts. Other than that, one more day moving along well. Today's volatility went higher after the close, this kept Today's profits at bay, let's see what Tomorrow brings.

No major change Today, except I had to update my trading plan as if we trade lower Tomorrow I will need to add a stronger put to compensate for the delta and Theta, this makes me tweak the adjustment on the second level down (do a strangle instead of selling the long Call) because of margin in one of my accounts. Other than that, one more day moving along well. Today's volatility went higher after the close, this kept Today's profits at bay, let's see what Tomorrow brings.Cheers!

Tuesday, March 8, 2011

3/8 Daily Summary

This is the quiet after the storm.. Let's hope so, this way I can land this trade with profits. So far it looks really good, a very positive recovery Today. I'll start peeling spreads out of the position either Tomorrow or Thursday morning, my goal is to keep the gamma exposure under control during these last few days of the trade.

This is the quiet after the storm.. Let's hope so, this way I can land this trade with profits. So far it looks really good, a very positive recovery Today. I'll start peeling spreads out of the position either Tomorrow or Thursday morning, my goal is to keep the gamma exposure under control during these last few days of the trade.All and all, it has sure been a great ride! No time to fool around, that's for sure!

Monday, March 7, 2011

3/7 Daily Summary

We are still navigating this storm. For the past 10 days, 6 were higher than 1 standard deviation and this causes the position to halt its recovery from day to day.. On the bright side I'm still in the game and as long as I can still make a profit I shall stay in the game. Come on NDX, let's settle down, will ya!?!

We are still navigating this storm. For the past 10 days, 6 were higher than 1 standard deviation and this causes the position to halt its recovery from day to day.. On the bright side I'm still in the game and as long as I can still make a profit I shall stay in the game. Come on NDX, let's settle down, will ya!?!Another positive note is that the weekend time decay actually paid off, notice how very little P/L was given up even though we had quite a bit of market activity from Friday to Monday.. This is a good sign.. My job as a sailor is to navigate the storm and be ready for when it settles down. Managing risk has been a key activity on this trade for MAR.

Friday, March 4, 2011

3/4 Daily Summary

First of all, a HUGE THANK YOU for all of those who posted your comments and emails on Yesterday's posting. Your support is a major part of my trading business, it keeps me going. Knowing I have the blog and the commitment to post whatever is going on with my position is truly a major benefit for my own trading.. You give me as much as I give you, if not more!

First of all, a HUGE THANK YOU for all of those who posted your comments and emails on Yesterday's posting. Your support is a major part of my trading business, it keeps me going. Knowing I have the blog and the commitment to post whatever is going on with my position is truly a major benefit for my own trading.. You give me as much as I give you, if not more!So, back to trading. I did stick around with the position, here is why: After the market opened, with little price variation the P/L was looking a lot better and in alignment with my estimate (down 20% instead of 30+), this and the weak market start allowed me to avoid pulling the plug and essentially decided to hang around with the position over the weekend. If we do get in trouble, my plan is to peel the trade slowly, first eliminating the spreads hurting me, then hedging as much as I can as to stick with some theta but very little gamma/delta exposure..

In any event, Today is a LOT better than Yesterday. Enjoy the weekend! Cheers!!

Gustavo

Thursday, March 3, 2011

3/3 Daily Summary

Today my dear reader, is my worst day in the trading business thus far! Don't get me wrong, the contingent orders did what they were supposed to do, I did my job with the plan last night, yet the modeling I had Yesterday failed to reflect the true life impact of a gap up + continuation of Today. The blow to the trade P/L was much higher than forecast, and all I have left to do is execute an orderly retreat. My job now is to take my risk off the table. Perhaps the spreads are just wide? Who knows, I'll see what Tomorrow looks like in the morning, but at this point the thing to do is start peeling off spreads.

Today my dear reader, is my worst day in the trading business thus far! Don't get me wrong, the contingent orders did what they were supposed to do, I did my job with the plan last night, yet the modeling I had Yesterday failed to reflect the true life impact of a gap up + continuation of Today. The blow to the trade P/L was much higher than forecast, and all I have left to do is execute an orderly retreat. My job now is to take my risk off the table. Perhaps the spreads are just wide? Who knows, I'll see what Tomorrow looks like in the morning, but at this point the thing to do is start peeling off spreads.It is a feeling of inadequacy that bothers me the most.. I'm not kidding around here, feel I left my family down with this one.. On the bright side, it will take me about 3 good months to fully recover, so it is not like it is a fatal blow and I'm out of business... Just a matter of time, and since this is for the long run, I shall pick up the pieces, come back Tomorrow and continue moving forward.

I have lessons to learn here, so will have to do some soul searching this weekend for sure.

Wednesday, March 2, 2011

3/2 Daily Summary

Tuesday, March 1, 2011

3/1 Daily Summary

Hanging on to those Puts really paid off Today! I was ready for any sort of down-side. I've been watching the last two up-side days and recognizing they were happening at lower volumes I kept my bearish bias and did not jump on the hand grenade by selling the puts too quickly.. Now I'm in a good position to finish cut and rolling, add the extra butterfly and push this trade to recover. If we stay quiet it will bring me my goals, if we keep moving around I can continue to manage it. It is a matter of time now to have theta kick in fast.. I also can't wait too much before adding any extra butterfly, as a matter of fact, am brushing with the limit to add new butterflies, I think it is still ok considering the volatility Spike from Today.

Hanging on to those Puts really paid off Today! I was ready for any sort of down-side. I've been watching the last two up-side days and recognizing they were happening at lower volumes I kept my bearish bias and did not jump on the hand grenade by selling the puts too quickly.. Now I'm in a good position to finish cut and rolling, add the extra butterfly and push this trade to recover. If we stay quiet it will bring me my goals, if we keep moving around I can continue to manage it. It is a matter of time now to have theta kick in fast.. I also can't wait too much before adding any extra butterfly, as a matter of fact, am brushing with the limit to add new butterflies, I think it is still ok considering the volatility Spike from Today.Bottom line, I'm staying alive, keeping it cool, recognizing and managing stress and managing the trade! That's what I expect from myself. :)

Subscribe to:

Comments (Atom)