Closing the trade slightly bearish Yesterday paid up this morning. As NDX crashed down it didn’t hurt my P/L, in fact, it brought it back up by a few percentage points. I used that money to Cut and Roll the put side, also added an extra butterfly to help pay for the cut and roll costs.

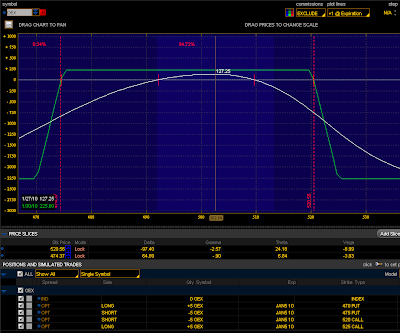

Now, take a look at this profile after the cut an roll. Notice that we moved way out of bounds and I'm still in the game, making Theta! I really like this 2.0 version of Dan Harvey's strategy. Yes, I'm down about 10%, but then again, I had a whipsaw effect Yesterday that knocked down about 5% of my trade, if it wasn't for that issue the trade would be down just about 5 to 6%.