I entered a new condor Today, am running out of time this evening, so I'll post the plan and studies Tomorrow.

Cheers!

Gustavo

Thursday, April 30, 2009

04/30 EWZ Double Diagonal

04/30 OIH 30-Day Condor

04/30 RUT and MNX Condors

04/30 Price Studies

Wednesday, April 29, 2009

4/29 EWZ Double Diagonal

EWZ Hit my first adjustment level Today. At 45.30 I moved 2 contracts from 44 to 47, cutting the Delta in half and giving now more space for the trade to work. Next adjustment will be to move the remaining contract if we hit 47.

I was confused Yesterday regarding Tighten the Noose, I then evaluated my strategies and decided to do so if I hit 70% of my profits. To make the decision process easier I added the levels to my P&L chart on the dashboard.

I was confused Yesterday regarding Tighten the Noose, I then evaluated my strategies and decided to do so if I hit 70% of my profits. To make the decision process easier I added the levels to my P&L chart on the dashboard.

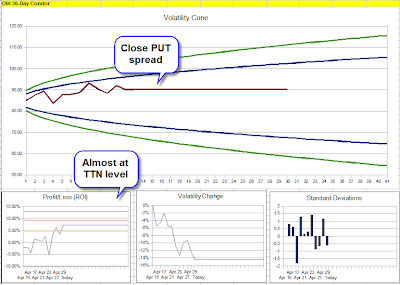

4/29 OIH 30-Day Condor

Today OIH contracts got changed due to a dividends distribution. I'm not sure how this affect my position in terms of liquidity on the new contracts. I'll stick with the normal plan and see where it takes me.

I also added the TTN levels to my P&L chart in the dashboard, this eliminates the doubt and facilitates my decision making in terms of when it is time to Tighten the Noose on the trade to lock in profits.

I also added the TTN levels to my P&L chart in the dashboard, this eliminates the doubt and facilitates my decision making in terms of when it is time to Tighten the Noose on the trade to lock in profits.

4/29 MNX 45-Day Condor

This position is taking just about the same ammount of up-side pressure as the RUT condor, yet the P&L seems to be in much better shape. Today I was able to close the Short PUT contracts for 5c. I have a running order on the Long PUT contracts, who knows, if the market sells off I might be able to get a hit on it.

There is a good chance (over 70%) it will be fine Tomorrow.

There is a good chance (over 70%) it will be fine Tomorrow.

04/29 RUT 52-Day Condor

The position is still on the board, yet it has been rough around the edges. Hard to take such a constant up-side pressure, however I made a plan and am sticking to it. There is still some chance (40%) we'll be fine Tomorrow. I usually see a reversal from the direction the day after FED announcement's, let's see if it happens Tomorrow.

Tuesday, April 28, 2009

04/28 OIH 30-Day Condor

04/28 MNX 45-Day Condor

04/28 RUT 52-Day Condor

4/28 Contingent orders maintenance

This morning I decided to perform a quick review of my contingent orders. I wanted to review the estimated P&L on Think or Swim price risk chart and compare with the delta on my short contracts.

Since all my contingent orders for my condors are defined by the delta of the short strikes I wanted to make sure the values I have are in line with the P&L levels for adjusting/closing the positions.

So, I've adjusted the contingent orders to the following positions:

RUT 52-day condor: Had order to shut down with short delta at or above 31, now it is at or above 30.

MNX 45-day condor: Had order to shut down if CALL side hit short delta of at or above 32, TOS was showing it to be too soon (P&L not yet -1.5x the cashflow), so I adjusted to at or above 35.

OIH 30-day condor: For the CALL side, the contingent to hedge remains with short delta at or above 35.

Since all my contingent orders for my condors are defined by the delta of the short strikes I wanted to make sure the values I have are in line with the P&L levels for adjusting/closing the positions.

So, I've adjusted the contingent orders to the following positions:

RUT 52-day condor: Had order to shut down with short delta at or above 31, now it is at or above 30.

MNX 45-day condor: Had order to shut down if CALL side hit short delta of at or above 32, TOS was showing it to be too soon (P&L not yet -1.5x the cashflow), so I adjusted to at or above 35.

OIH 30-day condor: For the CALL side, the contingent to hedge remains with short delta at or above 35.

Monday, April 27, 2009

04/27 - Take Profit Order

Today I learned an extra lesson: set up the "take profit" contingent orders on every trade as part of the OCO order to make adjustments. This will automatically take the risk off the table and lock-in profits when the market provides them.

I had this in place for the EWZ double-diagonal and RUT condor, it worked perfectly. Not quite working on the MNX condor, the order is there but there are no takers.. I forgot to place the order for OIH. Well, I was on vacation in a resort in Brazil.. I consider a success just the fact I was tracking the end-of-day market and with contingent orders in place..

One way or another, good to document it here on my blog.

I had this in place for the EWZ double-diagonal and RUT condor, it worked perfectly. Not quite working on the MNX condor, the order is there but there are no takers.. I forgot to place the order for OIH. Well, I was on vacation in a resort in Brazil.. I consider a success just the fact I was tracking the end-of-day market and with contingent orders in place..

One way or another, good to document it here on my blog.

04/27 EWZ Double Diagonal

4/27 OIH 30-Day Condor

OIH retraced a bunch Today. I kind of expected it after last Friday's wild jump. Usually when prices jump on "hopium", they come back down with the big hangover.. Let's see what else comes up.

NOTE: I did not have my take profit orders in place for the PUT spreads, that's a lesson learned for future trades.

NOTE: I did not have my take profit orders in place for the PUT spreads, that's a lesson learned for future trades.

04/27 - MNX 45-Day Condor

4/27 RUT 52-Day Condor

Friday, April 24, 2009

04/24 OIH 30-Day Condor

OIH pushed high Today, the position still in a decent shape considering we're hugging the up-side zone since the beginning. Now it is time to close th PUT spread and take our profits in a pull back.

I've added the profile for how the trade will look like closing the PUT spread and IF need to hedge just in the case OIH continues UP.

I've added the profile for how the trade will look like closing the PUT spread and IF need to hedge just in the case OIH continues UP.

Subscribe to:

Posts (Atom)