So, I decided to put everything in perspective, do some search to try and figure out what is going on? Why are these non-directional trades taking such beating? Is the market not appropriate for certain strategies? If yes, why?

I have a spreadsheet I created late 2007 when I started trading iron condors. I called it the "deviation study". This study is simple and it helps me to answer the following question: for the past 10 years, how many times did RUT stay within a certain range for X trading sessions?

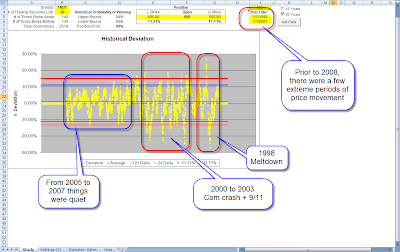

The results are displayed in a scatter chart, with the red lines indicating the 2 standard deviation range for the data and the blue lines indicating my proposed position.

See the picture bellow:

(A) Enter the Index and the number of trading sessions for the study

(A) Enter the Index and the number of trading sessions for the study

(B) Enter the current price and where the upper and lower strikes are

(C) Each yellow dot on the chart is a how much RUT moved (in percentage) for the number of days during the time period.

OK, now let's look at this study and put things in perspective: Prior to 2008, there were two cycles where you can clearly see the outliers going beyond the 10% range. These were times of high "uncertainty" and therefore higher volatility and stronger price swings.

Notice how things settled down, and the market was quite nice from 2005 till 2007. A perfect environment for trading non-directional strategies.

Now, compare the picture above with the most current picture, which includes 2008 and 2009. Notice how the outliers are much further away than during the previous cycles of "uncertainty".

As Jimmy Cliff's sound would say: "I can see clearly now the rain is gone... I can see all obstacles in my way"..

We are indeed trading in an environment of much higher uncertainty and stronger price swings. This is making it much more difficult for certain non-directional trading strategies.

What should we do as non-directional traders? Give up? Absolutelly NOT! The storm is what makes the sailor! Once we figure out how to navigate such amazing environment, we can set ourselves up to trade during any time period, and specially when things settle down as they did back in 2005.

I hope this helps. If anything, it is helping me to stay in the game and write off my current losses to sailing the storm. The boat may get damaged, but as long as I manage to trade smaller, I know I can survive this period and come out in a great position in the other end.

Cheers!

Gustavo