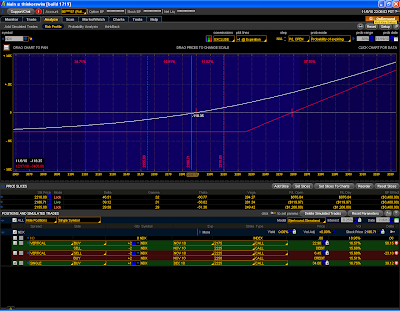

I've looked at a broken wing butterfly as an option, notice the two profiles bellow. The first is the front-month BWB and the second is a long back-month call. If we keep going up, the BWB will provide theta to the trade, while the long call will keep robbing me of theta. If we stay around the same level the BWB will not lose that much money, and if we back-fire they both seem to have the same rate of loss.

The key difference here is Vega and Theta. I have to do some more research and perhaps run a parallel Butterly next month with this option in play to see how it behaves in real life situation. For now it is just an idea to explore. Looks like a great idea though.. Thanks!