Nothing major Today, I expect Friday to be quiet. I'm planning to add an IBM Double/triple calendar following Himanshu guidelines, he has been trading these for over 4 years and is very satisfied with his results, so why not emulate?

SPY Double Diagonal and RUT 30-Day condorNo action required (as per trading guidelines), so all I have are alerts at the 1 st. deviation levels to check things again if we hit those levels. Nothing major and I am expecting Friday to be quiet.

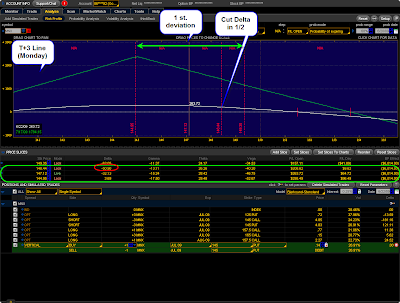

MNX Iron ButterflyI'm adding a long CALL on MNX to cut deltas in 1/2 if we get above 147.25, the guideline I discussed with Dan was keeping these deltas under control and bringing them back every time they get to be twice the theta. On the down-side, he suggested adding a calendar to help with Vega and cut deltas with a long put.