I entered a new condor Today, am running out of time this evening, so I'll post the plan and studies Tomorrow.

Cheers!

Gustavo

Thursday, April 30, 2009

04/30 EWZ Double Diagonal

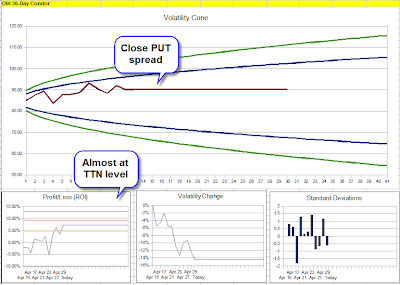

04/30 OIH 30-Day Condor

04/30 RUT and MNX Condors

04/30 Price Studies

Subscribe to:

Comments (Atom)