"All courses of action are risky, so prudence is not in avoiding danger (it's impossible), but calculating risk and acting decisively. Make mistakes of ambition and not mistakes of sloth. Develop the strength to do bold things, not the strength to suffer." -- Niccolo Machiavelli, The Prince

These are wonderful thoughts to hold in your mind if you think of trading as being a very risky proposition. Just about any aspect of our lives have risks involved, so is option trading risky? Of course it is, especially if you're a novice and don't quite know what can hit you. Just like driving is risky if you never drove before. The key is in calculating your risk, and acting upon it.

Start small, start with a paper account, but above all, START. It is far riskier to live your life wondering "what if"... Worse yet, to rely on someone else to take care of you money, your investments, your future. As we move out of 2009 and start 2010, decide what you'll pursue, how much you know and need to learn, calculate your risks, and go for it.

This is how I navigated the past year, since July 2008 the market started becoming very much risky for non-directional traders. I had decided I would pursue this style of trading and once committed, I couldn't just walk away and wait for better times. My decision was to scale back in my position sizing, and trade, test and learn the various strategies, see how they'd work out, see how they'd could be shredded to pieces if I was to trade them without a stop, learn, adapt, learn some more, but keep walking on the path.

Even though I ended up negative in 2009, I was down by less than 1.5% in my entire portfolio. Should I have kept on trading the same way I used to back when I had just started trading options (back when I knew close to nothing about options), I'm 100% sure I would have been wiped out at least a couple of times between July 08 and December 09. I learned to trade non-directional options strategies by adjusting the greeks and using risk management. I discovered what strategies I'm more confortable with, and I'm sure that I can keep on this path in 2010.

So, this is something I want to leave behind as we turn the page for the year. Manage and calculate your risks, and act upon it.

Thursday, December 31, 2009

12/30 Daily Summary

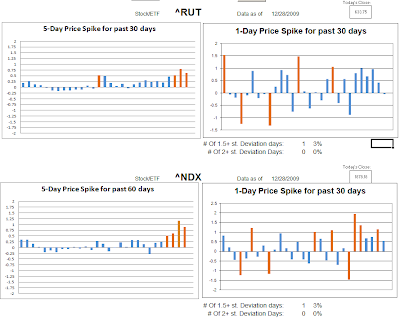

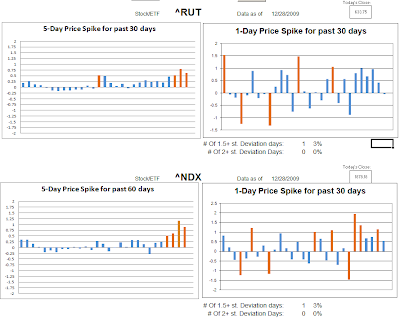

Today's price action happened in the last 30 minutes of the year. There was a big sell off. I was updating one of my tools and thought I had made a mistake when it showed the major indexes had dropped by more then 1 st. deviation.. My first automatic thought was: "oh, did I mess up my formulas??" Then I checked the charts and saw what happened :)

Well, no changes were made on any positions, and I'm glad I didn't jump the gun on rolling the 180 calls on the MNX.

Position's Details and Price Action chart:

12/31 MNX Iron Butterfly

Well, no changes were made on any positions, and I'm glad I didn't jump the gun on rolling the 180 calls on the MNX.

Position's Details and Price Action chart:

12/31 MNX Iron Butterfly

12/31 MNX Iron Butterfly

MNX rolled back down in the last 30 minutes of trading Today. I am glad I still have a bunch of the 185 calls, if I had rolled all of them up, I'd be finding myself worried about the down-side becoming a problem sooner than later. If we keep rolling down, my job will be to sell back the long FEB calls and wait for MNX to find footing under my tent.. If we push higher, then I'll just stick to the original plan: roll the 180 calls and stay in the game.

Wednesday, December 30, 2009

12/30 Daily Summary

Nothing major happened in the markets Today, we're still rotating around the top levels on most major indexes. My best guess is that everyone is waitting for next week in order to make a decision once the bulk of the market participants come back from the Holidays.

I've decided to close the RUT position Today after studying different alternatives with a decision making tool. I didn't touch the MNX position, but will continue to roll the short 180 calls if we keep pushing up Tomorrow, even if on low volume I simply can't take on too much risk going into next week.

Position's Details and Price Action chart

12/30 MNX Iron Butterfly

12/30 RUT Iron Condor

I've decided to close the RUT position Today after studying different alternatives with a decision making tool. I didn't touch the MNX position, but will continue to roll the short 180 calls if we keep pushing up Tomorrow, even if on low volume I simply can't take on too much risk going into next week.

Position's Details and Price Action chart

12/30 MNX Iron Butterfly

12/30 RUT Iron Condor

12/30 RUT Iron Condor

I closed down the position Today, we're hugging the 630 level and I'm not confortable with what can happen next week once volume comes back into the market.

Before closing the trade I ran a few different scenarios for possible adjusting to stay longer, after evaluating on an objective decision making tree, I decided to simply close down the trade. This decision making excercise was great.

Before closing the trade I ran a few different scenarios for possible adjusting to stay longer, after evaluating on an objective decision making tree, I decided to simply close down the trade. This decision making excercise was great.

12/30 MNX Iron Butterfly

12/30 Decision-Making Process: Should I stay or should I go?

I've shut down the RUT condor Today, now the key in this decision is not so much the action, but rather the decision-making process involved. I was starting to wonder if I should leave the position hedged for a longer period of time, or maybe jump with another type of adjustment. This type of thinking starts to clutter my mind when I find myself with a position in peril and hedged. It will lead into another set of thinking pattern: "man, I hate losing, I shouldn't give up, let me add something to make it work"..

There comes a point in time when trading must be treated like a business that it is, this point comes in different stages for different traders, but this has become cornerstone for me in the past few days.. I've reviewed all my trades, adjustments, decisions, thinking patterns and what not, and like I mentioned before, have started updating my trading plan for 2010. One of my goals is to establish a few strategies and trade them consistently month in, month out.

So, back to the decision making process: How can you turn doubt into conviction? If I simply closed the trade with that kind of thinking pattern in my mind, I'm 100% sure I'd spend the day walking around upset for taking a loss.

The answer is simple: Run a decision-making tree, and follow its advice/recommendations based on a the simple math of risk & probability & outcome. After I finished the exercise I'll describe bellow, my closing the trade decision came from a position of power. I simply knew it was the right thing to do and just went about doing it. Now, I'm feeling much better and confident I can come back next month and enter the trade again.

Step 1) Decide between a few adjustment options. My first step was to look at possible adjustments and come up with the best alternative. Here are the adjustment options I came up with:

A) Close trade, enter a new Low Prob condor

B) Close trade, enter a new High Prob Condor

C) Close the PUT spread, roll up the Call side and enter an iron-condor

The profiles are pictured bellow:

Once I knew the options, I also knew that once I went with adjusting, I'd have to hold this trade through expiration so it meant forgetting about current P/L and stop loss levels and use the break-even levels and probabilities it will stay within the B/E strikes as the new trade approach.

I ran the decision tree on the alternatives, and it came up with the Low Prob (Alternative A) being the best option.

Next step: Stay, Close or adjust? Same process, this time I took the Low Prob probabilities and outcomes and ran the decision tree to give me the best outcome. It told me to shut down the position as it is the less risky alternative.

I started peeling off the call spreads, then the PUT spreads didn't come off. So I wondered: should I even close the PUT side?? What do you think I did next? A new decision tree, this time it tells me that given probabilities, the best alternative is to leave them on, but notice here the margin is not so big between closing and leaving it open, so I feel that I can deviate from the decision tree and make the case for closing the PUT side: if a black swan event decides to happen right with those PUTs, I'll be very upset, much more upset than I am for giving up the extra $30 or $40 bucks I give up by closing them up.

Cheers!

Gustavo

There comes a point in time when trading must be treated like a business that it is, this point comes in different stages for different traders, but this has become cornerstone for me in the past few days.. I've reviewed all my trades, adjustments, decisions, thinking patterns and what not, and like I mentioned before, have started updating my trading plan for 2010. One of my goals is to establish a few strategies and trade them consistently month in, month out.

So, back to the decision making process: How can you turn doubt into conviction? If I simply closed the trade with that kind of thinking pattern in my mind, I'm 100% sure I'd spend the day walking around upset for taking a loss.

The answer is simple: Run a decision-making tree, and follow its advice/recommendations based on a the simple math of risk & probability & outcome. After I finished the exercise I'll describe bellow, my closing the trade decision came from a position of power. I simply knew it was the right thing to do and just went about doing it. Now, I'm feeling much better and confident I can come back next month and enter the trade again.

Step 1) Decide between a few adjustment options. My first step was to look at possible adjustments and come up with the best alternative. Here are the adjustment options I came up with:

A) Close trade, enter a new Low Prob condor

B) Close trade, enter a new High Prob Condor

C) Close the PUT spread, roll up the Call side and enter an iron-condor

The profiles are pictured bellow:

Once I knew the options, I also knew that once I went with adjusting, I'd have to hold this trade through expiration so it meant forgetting about current P/L and stop loss levels and use the break-even levels and probabilities it will stay within the B/E strikes as the new trade approach.

I ran the decision tree on the alternatives, and it came up with the Low Prob (Alternative A) being the best option.

Next step: Stay, Close or adjust? Same process, this time I took the Low Prob probabilities and outcomes and ran the decision tree to give me the best outcome. It told me to shut down the position as it is the less risky alternative.

I started peeling off the call spreads, then the PUT spreads didn't come off. So I wondered: should I even close the PUT side?? What do you think I did next? A new decision tree, this time it tells me that given probabilities, the best alternative is to leave them on, but notice here the margin is not so big between closing and leaving it open, so I feel that I can deviate from the decision tree and make the case for closing the PUT side: if a black swan event decides to happen right with those PUTs, I'll be very upset, much more upset than I am for giving up the extra $30 or $40 bucks I give up by closing them up.

Cheers!

Gustavo

12/29 Daily Summary

Not much happened in the market, we're rotating at the top, and a pull back might just happen. In fact, as I write this, futures are pulling back, but then again, the real action happens when the market opens, so we'll have to see what comes up then.

I have rolled one of my short 180 calls on the MNX Iron Butterfly, this cut my delta that was starting to get out of control. I might keep on rolling them this week if we don't show signs of a pull back. I might roll even if we pull back, as the deltas on these contracts are getting out of hand.

The 5-Day volatility chart is still strong on MNX, but weakening on RUT. No pull back in sight just yet.

Position's Details and Price Action chart

12/29 RUT Iron Condor

12/29 MNX Iron Butterfly

I have rolled one of my short 180 calls on the MNX Iron Butterfly, this cut my delta that was starting to get out of control. I might keep on rolling them this week if we don't show signs of a pull back. I might roll even if we pull back, as the deltas on these contracts are getting out of hand.

The 5-Day volatility chart is still strong on MNX, but weakening on RUT. No pull back in sight just yet.

Position's Details and Price Action chart

12/29 RUT Iron Condor

12/29 MNX Iron Butterfly

12/29 RUT Iron Condor

The trade continues hedged. I have exited the exact same copy I have of this position in my IRA accounts. I figure they are in a stop point, but in my cash account I'm testing my patience. The hedging bought me several days to think the trade over, but now it is starting to deteriorate, so if we don't pull back I will shut it down and get ready for next month.

12/29 MNX Iron Butterfly

I did 1 vertical roll to keep my deltas under control on the trade. I have to say, I'm keeping the delta hogs (short 180 Calls) for a bit longer than I want to. My feeling is that this upside swing needs a pull back and the lack of volume indicates that the heavy market players are all on vacation this week, so who knows what they might want to do once they come back Monday of next week..

Bottom line, now matter how hard you think about a decision, there is always a possible outcome that will prove you wrong. In my case, I've been trigger happy in the past, am trying to keep it controlled this time around. It may come back to haunt me.. we'll just have to see it.

Bottom line, now matter how hard you think about a decision, there is always a possible outcome that will prove you wrong. In my case, I've been trigger happy in the past, am trying to keep it controlled this time around. It may come back to haunt me.. we'll just have to see it.

Monday, December 28, 2009

12/28 Daily Summary

Not a whole lot of market action Today, we continue to post higher numbers on the 5-day volatility chart, but the 1 day price spikes are not so strong any longer. Today we had a gap up that got closed intra-day but bulls managed to sustain prices higher.

I did some maintenance on my RUT position early in the morning, and didn't touch the MNX position for one more day, contingent orders are in place, my goal is to work the MNX with contingent orders only.

Position's Details and price action chart:

12/28 RUT Iron Condor

12/28 MNX Iron Butterfly

I did some maintenance on my RUT position early in the morning, and didn't touch the MNX position for one more day, contingent orders are in place, my goal is to work the MNX with contingent orders only.

Position's Details and price action chart:

12/28 RUT Iron Condor

12/28 MNX Iron Butterfly

12/28 RUT Iron Condor

I've started simplifying the position by replacing the long FEB contract with buying one vertical spread and one of the short call contracts. This leaves me with a similar profile in therms of short term greeks, reduces the vega exposure and gives me a shot at exiting at a better price if we move back down or sharply up.

Next step is to work an order to remove the PUT side.

Next step is to work an order to remove the PUT side.

12/28 MNX Iron Butterfly

DEC09 Trades

I only had the Iron Condor for the DEC09 contracts, the market got into a trading range and the position worked itself to be a "set it and forget it" type of trade. Sweet!!

RUT Iron Condor - Day by day review

RUT Iron Condor - Day by day review

RUT Iron Condor - Day by day review

This was my only DEC09 trade, I opted for the iron condor simply because I was moving cross country and could not afford to look at the market every night, the Condor gave me the peace of mind that I could set it and forget it (for the most part), without a lot of adjustments in the process. As it turns out, the market was good to me.

Result: +17% ROI

11/12 RUT Iron Condor

11/13 RUT Iron Condor

11/16 Daily Summary (short posting)

11/25 Weekly update

Not much of a history, I understand, so here is a volatility cone profile for this position. Notice: the cone was created after the fact, so I can't add a live day-by-day P/L chart.

Result: +17% ROI

11/12 RUT Iron Condor

11/13 RUT Iron Condor

11/16 Daily Summary (short posting)

11/25 Weekly update

Not much of a history, I understand, so here is a volatility cone profile for this position. Notice: the cone was created after the fact, so I can't add a live day-by-day P/L chart.

NOV09 Trades

These are the positions I traded for the NOV09 contracts. This was the first losing month for my MNX Iron Butterfly position, not very happy, but still a profitable strategy thus far. I ended up blowing up my max loss on the RUT Iron Butterfly, as a result I decided to re-evaluate the way I've been trading the RUT Iron Butterfly, I simply haven't got a handle on the strategy.

NOV09 RUT Iron Butterfly - day by day review

NOV09 - MNX Iron Butterfly

NOV09 RUT Iron Butterfly - day by day review

NOV09 - MNX Iron Butterfly

NOV09 RUT Iron Butterfly - day by day review

This is my daily log of the RUT Iron butterfly position I traded with NOV09 contracts.

Results: -27.04% ROI

10/15 RUT Iron Butterfly *NOV* *New*

10/16 RUT Iron Butterfly

10/19 RUT Iron Butterfly

10/20 RUT Iron Butterfly

10/21 RUT Iron Butterfly

10/22 RUT Iron Butterfly

10/23 RUT Iron Butterfly

10/26 RUT Iron Butterfly

10/27 RUT Iron Butterfly

10/28 RUT Iron Butterfly

10/29 RUT Iron Butterfly - Added butterfly, increased Theta, increased risk

10/30 Daily Update - Closed RUT Beyond Max loss

Results: -27.04% ROI

10/15 RUT Iron Butterfly *NOV* *New*

10/16 RUT Iron Butterfly

10/19 RUT Iron Butterfly

10/20 RUT Iron Butterfly

10/21 RUT Iron Butterfly

10/22 RUT Iron Butterfly

10/23 RUT Iron Butterfly

10/26 RUT Iron Butterfly

10/27 RUT Iron Butterfly

10/28 RUT Iron Butterfly

10/29 RUT Iron Butterfly - Added butterfly, increased Theta, increased risk

10/30 Daily Update - Closed RUT Beyond Max loss

NOV09 - MNX Iron Butterfly

Here is a log (long overdue) of my MNX Iron Butterfly for the NOV09 contracts.

Results: -15% ROI

10/15 MNX Iron Butterfly *NOV*

10/16 MNX Iron Butterfly

10/19 MNX Iron Butterfly

10/20 MNX Iron Butterfly - "Added one more contract to the Iron Butterfly Today. I now have 1/2 of the position on. My deadline for being fully loaded is this Thursday."

10/21 MNX Iron Butterfly

10/22 MNX Iron Butterfly - Added the second 1/2 of the position Today, so far this trade has been going on very well.

10/23 MNX Iron Butterfly

10/26 MNX Iron Butterfly

10/27 MNX Iron Butterfly

10/28 MNX Iron Butterfly

10/29 MNX Iron Butterfly

11/02 MNX Iron Butterfly

11/03 MNX Iron Butterfly

11/04 MNX Iron Butterfly

11/05 MNX Iron Butterfly

11/06 MNX Iron Butterfly

11/09 MNX Iron Butterfly

11/10 MNX Iron Butterfly

11/11 MNX Iron Butterfly

11/12 MNX Iron Butterfly

11/13 MNX Iron Butterfly

11/16 Daily Summary (short posting) - Condorized and let it expire

Results: -15% ROI

10/15 MNX Iron Butterfly *NOV*

10/16 MNX Iron Butterfly

10/19 MNX Iron Butterfly

10/20 MNX Iron Butterfly - "Added one more contract to the Iron Butterfly Today. I now have 1/2 of the position on. My deadline for being fully loaded is this Thursday."

10/21 MNX Iron Butterfly

10/22 MNX Iron Butterfly - Added the second 1/2 of the position Today, so far this trade has been going on very well.

10/23 MNX Iron Butterfly

10/26 MNX Iron Butterfly

10/27 MNX Iron Butterfly

10/28 MNX Iron Butterfly

10/29 MNX Iron Butterfly

11/02 MNX Iron Butterfly

11/03 MNX Iron Butterfly

11/04 MNX Iron Butterfly

11/05 MNX Iron Butterfly

11/06 MNX Iron Butterfly

11/09 MNX Iron Butterfly

11/10 MNX Iron Butterfly

11/11 MNX Iron Butterfly

11/12 MNX Iron Butterfly

11/13 MNX Iron Butterfly

11/16 Daily Summary (short posting) - Condorized and let it expire

Sunday, December 27, 2009

12/24 Daily Summary

I did not trade on Friday, to be honest, I completely forgot it was a short day, well, not much changed on my positions, except that I'd like to have rolled a few more contracts on the MNX Iron Butterfly at the end of day, but nothing that can't be fixed on Monday.

The 5-day profile still shows upside pressure from quite a few days in a row now, and we're pushing to the extreme, so this might continue in the next days.

In the meantime, I'm working on a 2009 review, going over what worked, what didn't, and how to make improvements, this is a much needed exercise and is sheding some light in a lot of the strategies I've been using. Specially giving the fact I will be on a full time job in 2010, so I will have to be selective with what and how I trade.

Position's Summary and Price action:

12/24 MNX Iron Butterfly

12/24 RUT Iron Condor

The 5-day profile still shows upside pressure from quite a few days in a row now, and we're pushing to the extreme, so this might continue in the next days.

In the meantime, I'm working on a 2009 review, going over what worked, what didn't, and how to make improvements, this is a much needed exercise and is sheding some light in a lot of the strategies I've been using. Specially giving the fact I will be on a full time job in 2010, so I will have to be selective with what and how I trade.

Position's Summary and Price action:

12/24 MNX Iron Butterfly

12/24 RUT Iron Condor

Thursday, December 24, 2009

12/24 Merry Christmas!

I decided to not trade this morning, will post details on my positions over the weekend, for now enjoy the Christmas Holiday!

Merry Christmas!

Gustavo

Merry Christmas!

Gustavo

Wednesday, December 23, 2009

12/23 Daily Summary

Today's price action on RUT caught me off-guard, I was expecting volatility to drop, but it didn't, so I had to exit the position in the last hour. I tried filling the spread but could not get a fill, and therefore decided to hedge with a back-month long Call. As it turns out, in hindsight I would be much better off by hedging with a JAN contract, as it would leave me exposed to less Vega risk. See both profiles in the position's detail. My plan is to work my way out of the spread Tomorrow or Monday.

MNX also kept pushing higher, I now have an up-side alert on the 5-day Volatility chart, so I decided to start rolling a few of the 180 Calls, hedging against a continued move upward. I don't have contingent orders to the up-side for Tomorrow, if it moves higher I'll trade the long Calls for the vertical spreads to roll the delta hogs (180 Calls).

Positon's Details and Price action charts:

12/23 MNX Iron Butterfly

12/23 RUT Iron Condor

MNX also kept pushing higher, I now have an up-side alert on the 5-day Volatility chart, so I decided to start rolling a few of the 180 Calls, hedging against a continued move upward. I don't have contingent orders to the up-side for Tomorrow, if it moves higher I'll trade the long Calls for the vertical spreads to roll the delta hogs (180 Calls).

Positon's Details and Price action charts:

12/23 MNX Iron Butterfly

12/23 RUT Iron Condor

Tuesday, December 22, 2009

12/22 Daily Summary

Today's upside continuation places the RUT condor in a rough spot, it is starting down the slipery slope and although not exactly 0.5 st. deviation, Today's spike on the 5-day price chart is close enough to 0.5 that raises a flag to me. A pull back is needed in order for the position to stay.

The MNX Iron Butterfly had a couple of rough days as well, but was able to keep most of its profits, now I will start doing vertical rolls if we keep pushing to the up-side.

Position's Details and Price action chart:

12/22 MNX Iron Butterfly

12/22 RUT Iron Condor

The MNX Iron Butterfly had a couple of rough days as well, but was able to keep most of its profits, now I will start doing vertical rolls if we keep pushing to the up-side.

Position's Details and Price action chart:

12/22 MNX Iron Butterfly

12/22 RUT Iron Condor

Monday, December 21, 2009

12/21 Daily Summary

One of the things I noticed about Today's upside movement was the lack of volume, this could simply be a factor of the Holidays season, or an indication that this up-side push won't materialize a new up-trend. I'm personally expecting the later.

My RUT position is still hovering around the break-even level, notice the 5-day volatility chart that this persistent upside has been keeping my profits at bay on the trade; Should we see a small pull back, the position will be good to cash out.

The MNX Iron Butterfly had its first set of adjustment done Today. I had a contingent order to cut a few deltas, and after it triggered I added another one to continue cutting in case we kept pushing higher, which we did. So I purchase 2 long FEB 185 Calls to keep these deltas at bay. The position gave back about 3% of its open P/L Today.

Position's Details and Price action charts:

12/21 MNX Iron Butterfly

12/21 RUT Iron Condor

My RUT position is still hovering around the break-even level, notice the 5-day volatility chart that this persistent upside has been keeping my profits at bay on the trade; Should we see a small pull back, the position will be good to cash out.

The MNX Iron Butterfly had its first set of adjustment done Today. I had a contingent order to cut a few deltas, and after it triggered I added another one to continue cutting in case we kept pushing higher, which we did. So I purchase 2 long FEB 185 Calls to keep these deltas at bay. The position gave back about 3% of its open P/L Today.

Position's Details and Price action charts:

12/21 MNX Iron Butterfly

12/21 RUT Iron Condor

Friday, December 18, 2009

2010 Goal: Revise and update trading plan

I mentioned this before, but I need to revise and update my original trade plan, it was put together in 2007 back when I was trading FOREX, the plan's structure is still very valid, but obviously a lot has changed since the plan was first put together.

Still in the subject of a trading plan, here is the template I used to create my own plan:

http://www.trade2win.com/media/knowledge/tim-wilcox/T2W_Trading_Plan_Template_2005.pdf

I plan on publishing my trading plan on this blog, but if you want to work on your own, the link above should help.

Cheers to our success!

Gustavo

Still in the subject of a trading plan, here is the template I used to create my own plan:

http://www.trade2win.com/media/knowledge/tim-wilcox/T2W_Trading_Plan_Template_2005.pdf

I plan on publishing my trading plan on this blog, but if you want to work on your own, the link above should help.

Cheers to our success!

Gustavo

2010 Goal: Have a plan and stick to it

Needless to say, I trade with a plan and stick to it! That has helped me to remove a lot of the anxiety associated with making a decision on the fly, specially when the position is in trouble.

Moving into 2010, I will take this to the next level, publishing a trading plan for each strategy I use will help me and fellow readers to understand what exactly that I'm doing for each position.

Having a plan and backing it up with contingent orders will help me to be hands off (another 2010 goal) and at the same time activelly involved in the market.

My plan should also include Exceptions (a list of weird scenarios I delt with in the past). Documenting these exceptions and what to do in case they happen again, is part of this 2010 goal.

Moving into 2010, I will take this to the next level, publishing a trading plan for each strategy I use will help me and fellow readers to understand what exactly that I'm doing for each position.

Having a plan and backing it up with contingent orders will help me to be hands off (another 2010 goal) and at the same time activelly involved in the market.

My plan should also include Exceptions (a list of weird scenarios I delt with in the past). Documenting these exceptions and what to do in case they happen again, is part of this 2010 goal.

2010 Goal: Active Engagement through practice

Trading non-directional income strategies with options isn't an active type of trading. You place your trades and the best positions are those that you don't have to touch again until you need to take your profits. While this is great in theory, in practice one has to learn to control some degree of anxiety that comes up when you are looking at the positions from day to day, specially when profits begin to show.

I have realized that one of the best ways for me to control the activity anxiety is to use my time backtesting the systems and strategies I'm using over time.

Backtesting gives me a clear sense for how a certain strategy migh perform, but in addition to that, it gives me an active way to "stay busy" sort of speak without actually trading or touching up the positions all the time. When you backtest, you need a set of rules, and by using these rules over and over, month after month, you begin to learn how a certain trade performs, and you also learn to not touch the position just because you're anxious about a certain scenario/condition.

Keeping track of past performance, also helps you to identify how good of an edge you are trading. Will your strategy make money over time? The very first way to test this is by testing with historical data, then you start to build up live results to compare/contrast with your backtesting. Having some sort of "backing" to say that the strategy I'm using has a positive edge is another major benefit from backtesting.

I'd actually say, that having a clear picture of the position win-loss ratio, and its risk : reward profile is a MAJOR benefit for me, specially when I have to enter a new trade after a losing month. Having some information allows me to look past the most recent negative experience and see the long-term benefit of the strategy.

That being said, one of my goals for 2010 is to use a good portion of the time I dedicate to the trading business to backtesting.

I have realized that one of the best ways for me to control the activity anxiety is to use my time backtesting the systems and strategies I'm using over time.

Backtesting gives me a clear sense for how a certain strategy migh perform, but in addition to that, it gives me an active way to "stay busy" sort of speak without actually trading or touching up the positions all the time. When you backtest, you need a set of rules, and by using these rules over and over, month after month, you begin to learn how a certain trade performs, and you also learn to not touch the position just because you're anxious about a certain scenario/condition.

Keeping track of past performance, also helps you to identify how good of an edge you are trading. Will your strategy make money over time? The very first way to test this is by testing with historical data, then you start to build up live results to compare/contrast with your backtesting. Having some sort of "backing" to say that the strategy I'm using has a positive edge is another major benefit from backtesting.

I'd actually say, that having a clear picture of the position win-loss ratio, and its risk : reward profile is a MAJOR benefit for me, specially when I have to enter a new trade after a losing month. Having some information allows me to look past the most recent negative experience and see the long-term benefit of the strategy.

That being said, one of my goals for 2010 is to use a good portion of the time I dedicate to the trading business to backtesting.

12/18 Daily Summary

The MNX position is working great, have not touched it and it is up over 10%, the RUT trade still around the B/E levels. The market is in a choppy channel, no signs of break out, the 5-day price action charts are looking really good.

Position's Details:

12/18 MNX Iron Butterfly

12/18 RUT Iron Condor

Position's Details:

12/18 MNX Iron Butterfly

12/18 RUT Iron Condor

Subscribe to:

Posts (Atom)