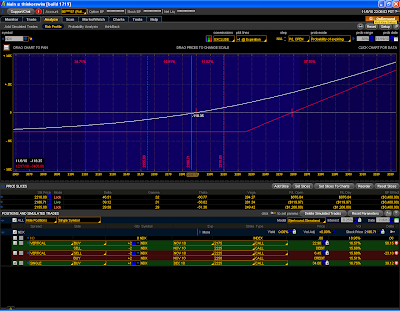

I've looked at a broken wing butterfly as an option, notice the two profiles bellow. The first is the front-month BWB and the second is a long back-month call. If we keep going up, the BWB will provide theta to the trade, while the long call will keep robbing me of theta. If we stay around the same level the BWB will not lose that much money, and if we back-fire they both seem to have the same rate of loss.

The key difference here is Vega and Theta. I have to do some more research and perhaps run a parallel Butterly next month with this option in play to see how it behaves in real life situation. For now it is just an idea to explore. Looks like a great idea though.. Thanks!

7 comments:

Hey there Gustavo. I've been doing BWBs on OEX for the last 6 months with good results. What software are you using for your charting and game plan?

Isnt it easier to manage the long call, what do you do with the bwb if the market retraces south, do you just leave it on and then add back month puts as needed? With the long call, you can just sell it.

Hi there Steve, I don't use any specific software, just ms excell and open office Calc to track my trades.. I want to consolidate and transition to Open office calc, but have not yet taken the time to convert all the formulas I've already created in excel.

About the long call, yes, it is easy to get rid of them when they no longer help you.

I will start looking at the BWB as an option, say the first adjustment with the BWB and the second with the long calls/puts. That being said, I will first trade them on a paper account to see how they work and yes, I need to figure out what to do in order to get rid of them.

So far, the benefits are: Theta, Delta and less vega. The drawback is that they do not cut the Gamma that much and I don't yet know how to set them up as contingent orders.

One must always consider how he/she trades on a daily basis. In my case, I use contingent orders because I work all day and barely have time to watch the market at lunch time.. So I use contingent orders and they are very dependable for single contracts, but I'm not sure how they'd work for complex spreads such as butterflies or even for debit/credit spreads..

Take care!

Gustavo

Hi Gustavo,

I find it better to set an alert and place the trade myself than rely on contingent orders after either not being triggered or get bad fills in the past.

Please could you go into more detail if possible about your %age of std dev moves in last 30 days using high to low? You use the 20 day HV then is it just the range of the previous day or low pf previous to high of today or something??

Cheers

DZ

Hi there, I can't rely on myself being available to place the trade, that's why I use single orders in contingent orders.

Regarding the % of days, I use the calculated 20-day volatility to identify the 1 standard deviation range up and down. Then, for every day I count if we passed these numbers to either side.

The % of days is nothing more than the number of days in the past 30 days that have traded over that range (up or down) intra-day. This is shown as a % number. Hope this answers your question.

Cheers,

Gustavo

Hi Gustavo,

I think you just described the Day Price spike. I'm talking about the % days measured low to high not just close (your bottom graph of the top image from 11/05).

Cheers

DZ

Post a Comment